Advanced technology in the banking industry has made transactions safer, faster, and more efficient for banking staff as well as customers. Gone are the days of manually processing checks and transactions. Core banking systems empower banks to create streamlined, centralized processes across every branch in their system, improving customer experiences and strengthening internal infrastructure.

What Is a Core Banking System?

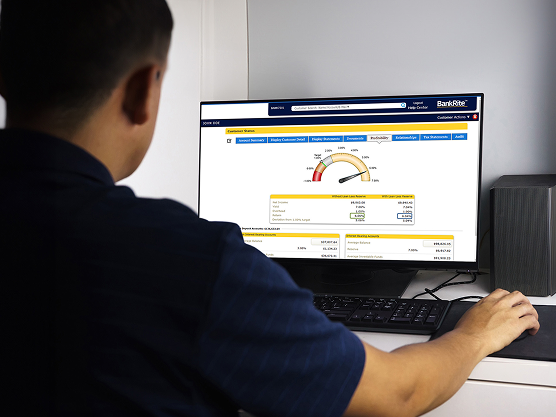

A core banking system is a centralized back-end system designed to process and support transactions across branches of banks. At the front end, a core banking system offers all the services customers and banking professionals need to handle finances. On the back end, a core banking system processes data securely and reduces the risk of fraud.

Besides adequate funding and strong management, what all banks need is a core banking system. They provide the essential services a bank needs to keep data and savings safe, and at the same time, providing an optimal user experience for customers. A core banking system generally includes these main services at the heart of most banks:

-

Processing deposits and withdrawals

-

Managing new accounts

-

Calculating interest

-

Servicing loans

-

Managing customer accounts

-

Processing checks

-

Keeping records

-

Managing fraud and risk

What Are the Benefits of Core Banking Systems?

Before innovations in banking technology, bankers had to manually calculate interest and manage customer records. As the internet has become commonplace, banks needed to utilize software that could keep customer data secure and automate many of these manual banking processes. Core banking systems bring everything that banks need to carry out essential operations, cutting down on manual work and helping banks provide services necessary in the 21st century.

-

Uniform experiences across all branches. Core banking systems make it easy for banks to provide uniform experiences at every branch of a banking system. This means that a customer can expect the exact same experience at an ATM at any branch location across the country — or even across the world. Core banking systems can also translate this uniformity to online and mobile experiences, ensuring simplicity and security while depositing checks, transferring funds, or checking account balances.

-

Customer empowerment. These days, there is less dependence on manually balancing a checkbook or writing out a budget. Core banking systems empower its bank client’s customers to know exactly what’s going on with their money and to access that knowledge with a few taps on a smartphone or tablet. Customers have the freedom to conduct their banking according to their individual preferences. This can mean faster payment processing and accessing services round-the-clock.

-

Stronger banking infrastructure. Core banking systems exist not just to improve user experience and uniformity, but also to organize internal banking operations. This can be helpful for banks looking to improve performance and save costs on manual banking, but can also be a solid foundation for De Novo banks looking to start strong. Banks run less risk of human error with core banking systems, improving documentation processes and customer retention.

-

Regulatory compliance. The banking industry is, of course, highly regulated. Banks need to meet certain government standards to operate on a national scale, and core banking systems can help them do this. With a focus on fraud prevention and risk management, core banking systems ensure that customer data and funds are safe and internal employee operations are standardized and transparent.

-

Security and risk analysis. With so much customer data living in bank’s systems — and ever-present hacking threats — banks need to implement systems for risk analysis. Every aspect of a bank’s operations, from depositing checks to withdrawing cash, needs to pass through a system of risk analysis. This oversight prevents fraud, keeps customer data secure, and mitigates risks before they turn into serious problems.

Finding the Right Core Banking System for Your Bank

There are many core banking systems out there, some of which are built for massive banking institutions, and others for de novo banks and smaller systems. When you look for core banking technology for your bank, there are a few factors you should consider:

-

The company’s experience in the banking industry

-

Specialization — compatible with large, medium, or small bank systems

-

Range of products and services

-

Clearly identified de-conversion fees, if you decide to move from one core to another

The ideal core banking system should be able to handle however many transactions that occur across all branches of your banking institution. It should be able to support every service your customers expect, including deposits, loans, and online accessibility. Whichever company you choose should have plenty of experience in the banking industry, ensuring that your needs are met and your data stays secure in the face of future challenges.

BMA Core Technology is a leader in core banking systems, providing innovative, intuitive software for banks of all sizes. With close attention to customizing the system to your needs, customer support and a strong background in security, BMA can ensure your banking services go smoothly while your information stays safe from potential risks.

Contact BMA Core Technology to request a demonstration and to learn how core banking technology can improve your bank’s operations.