Financial institutions require powerful technology solutions that can keep up with ever-changing client needs. Patrons expect their banks and credit unions to offer a full suite of digital services, and financial institutions need a core banking software that prioritizes speed, flexibility, and security.

Given the amount of core banking platforms in existence, choosing the right one can feel paralyzing. There are some steps financial institutions can take to ensure they select the one that meets all of their needs.

Determine your needs

You should have a general idea of what services your financial institution needs before you begin choosing a core system. If you already have a core banking platform in place, then you should start the selection process by performing a gap analysis. Assess what is working with your current software, as well as the functionality that is missing. This assessment helps you know what to look for — and what to avoid — in your new processing system.

Evaluating your software needs will help you better conduct software research. You’ll be able to ask educated questions during product demos, instead of just seeing the features and services the vendor thinks are important. List all of your reporting requirements and the minimum level of customization you are comfortable with ahead of time. Make sure your requirements are explained in detail and that they include both the data requirements and the processing requirements.

Prioritizing the needs and wants for your institution is also critical. Which technology functions or support capabilities are an absolute must, outweighing any other features? When choosing between multiple software options, your priorities will help guide your decision.

Perform preliminary vendor research

Now, it’s time to start gathering basic information about your vendor options. Compile a list of software options that are suitable given the size of your financial institution. Then, start digging. You need to know the general functionality of each software option, but you don’t get too deep in the weeds. More specific questions about the functionality will be answered during proof-of-concept workshops.

When it comes to discovering and comparing the cost of the software, make sure you know the complete cost, including any hidden fees or assumed costs, including internal resources.

Here is an example of what you might look for as you research core processing system vendors:

- Customer Service Availability

- Functionalities

- Cost

- Performance

- Safety and security

- Program management

- Flexibility

- Open System Architecture

- Customization options with Cost and Timing Structures

You also want to know the future prospects of the vendor, because you should plan on partnering with the vendor for a while. Look for features that you don’t need now, but you might in the future, and ask the vendor about any future plans and the process for system enhancements. After you complete your research, your vendor selection list should be trimmed down.

Test Vendors

Put the software to the test to make sure it meets all of your requirements. You can either do a proof-of-concept or a test system pilot of the software. During this step, you should ask questions about how the core processing system is designed so you can coordinate an implementation plan with your current IT set-up.

During this time, you should learn more specific information about the functionality and operational performance of the software. Be sure to gain a good understanding of the software and how it fits into your financial institution.

Finalize Your Selection

Once you have culled the contenders to two or three vendors, you’re ready to make your selection. Revisit the requirements that you wrote at the start of the process, making sure that all of your needs are met. Assess the technology, pricing, implementation plan, and any other decision factors.

If your financial institution is switching from another core banking software, ask about the timing and de-conversion costs from you contract. A flexible service oriented and simple implementation process can be extremely beneficial and might sway your decision.

After all of the research and testing, you are ready to make a decision and start work on implementation. You need to make sure you allow for a minimum of 6 to 9 months for this process.

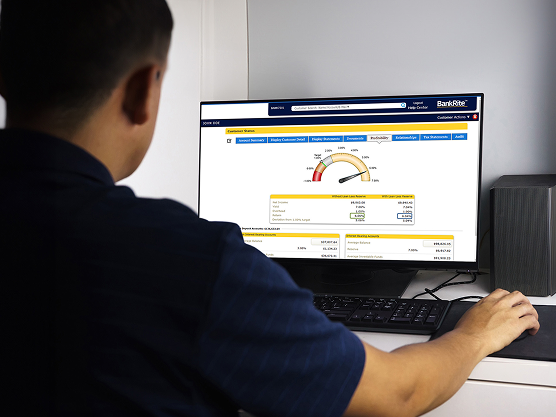

BMA provides innovative core processing solutions, open architecture and top-quality customer service. Our software solutions help banks, credit unions, and ILCs stand apart from their competitors and serve their customers. To learn more about our software solutions, visit https://avalaunchsites.com/bma/solutions/.