If a bank determines to review its core software platform, it might decide to perform a software conversion to replace it with a state-of-the-art system. A conversion can be undertaken for several reasons:

- The obsolete legacy system prevents expansion and growth

- The existing platform can no longer manage workflow

- The software has governance, risk, and compliance issues

- The outdated system provides a poor customer experience

- The current platform cannot integrate with other systems

- Disparate data sources reduce reporting and analytic capabilities

- Poor customer service where it becomes more difficult to make improvements

- Costs too much due to either monthly or yearly unexplained increases

What Is Core Conversion for a Bank?

A bank’s core processing software manages all basic banking transactions from deposits and withdrawals to bill payment and loan origination. After conversion, a bank can expand its service offerings, increase the availability of funds, and fine-tune the customer experience.

Most of the changes won’t be apparent to customers. Account numbers, passwords, balances, and account information will remain the same. Nevertheless, customers may notice new and improved features with their online or mobile banking

What Is a Bank Conversion Benefit?

With the flexibility presented by a core upgrade, a bank can offer products and services that are fully customized to meet the demanding needs of customers.

The case for software conversion became crystal clear during the pandemic. Homebuyers, title companies, banks, realtors, credit unions, and notaries needed technology to keep the housing market up and running. However, obsolete core systems severely limited the services and support that bank provided.

The demand for core conversion wasn’t limited to the real estate industry. Bank customers demanded to open depository account and start loans, all online. New capabilities were also required to close mergers and acquisitions. Additionally, bank conversions were necessary to foster digital engagement with customers and thereby enhance the customer experience.

Why Is Conversion So Important Now?

Technology doesn’t sit still, and as it expands; it imposes obsolescence on technology that is antiquated. The great majority of banking platforms are obsolete. However, before the pandemic, they were still functional enough to satisfy the needs of most customers.

The pandemic has raised the stakes to create more online and digital services and products that won’t require bank customers to physically walk into a bank. Now, banks must update their core systems to keep up with the demand for remote capabilities.

Legacy System Limitations

Legacy software systems are outdated software & hardware systems that are still in service. The needs that it fulfilled when it was created were applicable back then but are no longer being met today. The Legacy software is unable to expand and satisfy the new needs of bank customers today. It can’t interact with newer systems, and because of its inherent limitations, it prevents a bank from making product and service upgrades. To make matters worse, the maintenance that legacy systems require is time-consuming and expensive.

The Problem with Legacy Systems

Obsolete operating platforms can cause trouble. Data silos prevent the integration of information when that information can only be accessed by certain departments and is inaccessible to others.

Legacy systems can wreak havoc on compliance with government regulations, and obsolete platforms are vulnerable to attack by cybercriminals. At some point, the cost of maintaining an obsolete core will become greater than the challenges of conversion.

Maintaining obsolete software can be expensive to maintain. Although all computing systems require proper maintenance to perform optimally, legacy systems need excessive maintenance. It’s like trying to maintain an old car, it seems like it’s always in the shop for repairs.

Ongoing maintenance is the only thing that keeps old systems up and running. Meanwhile, outrageous maintenance costs generate little ROI. Eventually, these systems lose all support as updates are discontinued. If the system fails, you’ll have a major mess on your hands.

Why is Core Conversion such a big decision for a bank?

Whether or not to initiate a core conversion is not an easy call to make. Here are some of the reasons why banks are reluctant to take this critical step:

Costs

Undertaking a conversion process requires commitment and dedication. It also necessitates a large upfront cash outlay to cover the considerable costs of material and manpower.

Banks are historically conservative institutions. They want to be reasonably certain that their ROI will be worthwhile.

Resistance

It’s not easy to upgrade an entire banking system. It takes a significant amount of time, attention, and cooperation to get the job done right without disrupting the operations of the bank.

Employees and managers alike can feel frustrated, resentful, and confused by the steep learning curve they are confronted with as the upgrades are being implemented. That can lead to internal strife, stress, and resistance.

Challenging

It can be challenging to find people with the requisite skills to complete a conversion. Some legacy systems were constructed using an obsolete programming language that is obsolete and does not allow for smooth integrations into other valuable banking services.

Migrating data from an old system into a new system needs to be carefully transferred to the new core and some data can be lost if not indexed correctly.

Benefits of a Core Conversion

As formidable as a core conversion might seem, it can still proceed with minimal disruption when you partner with experienced professionals, like BMA, which has over 35 years of experience. The entire process takes between six to nine months to complete, although some conversions can take longer.

Much of the work is done by the new core provider but the bank is very involved in making sure that the products/services promised are being delivered.

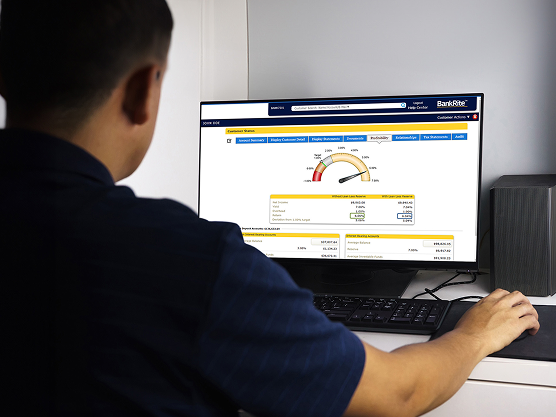

A new core operating system will transform the banks’ ability to be more competitive with banks that have already converted to the newer technology. Products such as digital account opening at the convenience of your tablet, computer, or smartphone are becoming the new norm. Advanced reporting capabilities and clean data result in a system that’s efficient, expansion-friendly, and primed for growth.

Contact BMA to schedule a free introductory call, discovery meeting, and consultation regarding how improved technology will improve your bottom line. www.bmabankingsytems.com.