Core banking is vital software that keeps bank systems up to date in providing the latest feature and products that customers depend on and expect. Because of the vast competition between banks and credit unions, customers have options in selecting a financial institution that best meets their needs.

If you are wondering what core banking is, what the software can do, and how it can help your bank or credit union, read on to learn more.

What Is Core Banking?

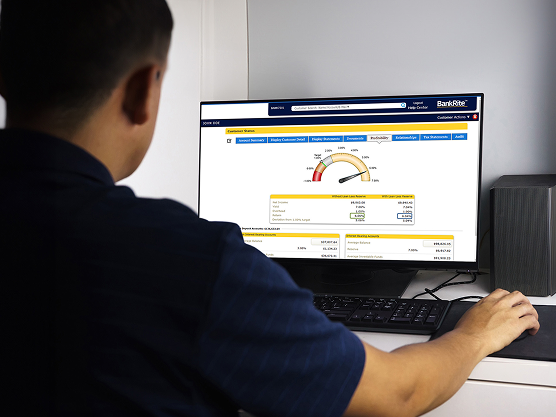

Core banking is a behind-the-scenes software system that handles a variety of banking transactions for the bank and its clients. It processes daily transactions from credit and debit cards to online and mobile purchases or payments. You can receive monthly statements, tax reporting and manage your accounts through money management tools. A core provider can conduct processing services for deposits, loans, general ledger, IT as a Service (ITaaS), and much, much more.

Core banking software also connects all the branches of a bank, ensuring customers can visit any bank branch and still access their account and needed services. This also applies to mobile banking, which allows customers to complete banking transactions anywhere and at any time.

Core Banking Software Capabilities

While core banking software makes banking more accessible for customers, there are several reasons a core provider can be beneficial to your bank or credit union as well. Core banking software capabilities include technology integration, expansion scalability, digitized banking, customized solutions, resource services, and strategic collaboration.

Technology Integration

A core provider should have software that enables seamless integrations to your existing system and third-party providers. This is done through open banking or APIs (application programming interface), which facilitate communication between two separate systems that wouldn’t be able to communicate otherwise. An API also safeguards information between each system, determining which is necessary for both sides.

For banking institutions operating with older software systems, an API in core banking software bridges the gap between new and old systems. This helps them operate more efficiently, function faster, and last longer. Technology integration also helps banks and credit unions avoid costly, time-consuming system overhauls when old processes stop working.

Expansion Scalability

A core banking software provider must meet current customer and institutional needs. That’s what makes them a vital software addition for any banking provider. Yet, technology is continually changing and improving, meaning bank services are being digitized — or created — all the time. Core banking software must have the ability to expand or scale services as your bank grows.

When core technology is flexible and expandable, you can easily add new services, streamline existing processes, and provide a better experience for your customers that is faster, easier, and more productive.

Digitized Banking

Most people handle banking transactions from a personal computer or mobile device. This means your banking services are easily accessible online. With the right core software provider, your customers can complete money transfers, open new accounts, apply for loans, or even begin the mortgage application process on your phone or computer, making banking tools and access to loans/deposits quick and easy

Customized Solutions

If your financial institution specializes in mortgage loans or checking accounts, you may not need optimized solutions for credit cards or other services. A core banking provider can customize solutions to your institution’s specific needs without paying for products that you do not need or want.

Resource Services

Core banking software can feel overwhelming if your employees don’t understand what the software can do. Your core banking provider should offer learning resources to help banking professionals make the most of the software. You can work with your core provider to develop employee training sessions, oversee internal projects and programs, implement high-quality management plans, and create test strategies for future system use.

Strategy Collaboration

If you want to grow your banking services but aren’t sure where to start, a core banking provider can help. You’re creating a partnership where ideas can be exchanged, and new processes can be planned out. You’ll be able to stay on top of current market trends, discover new banking technologies, and monitor what your competitors are doing so you can match or exceed their services.

Additional Core Banking Software Features

You need a core banking provider that meets your institution’s needs. This means researching current providers and identifying one that most closely matches what you’re looking for. Here are some additional main features and capabilities that your core banking software may include.

- Open new accounts such as checking, savings, or CD’s

- Complete a loan online without having to step inside the bank

- Online bill pay

- Process mobile deposits

- Provide account updates

- Receive alerts on credit or debit charges

- Turn your credit or debit card on or off using your smartphone

- Maintain customer security

- Customer money management tools

- General ledger management

- Interest management calculations

- Stored customer data

- IT as a Service (ITaaS)

You can learn more about finding a good core provider here.

Why Choose BMA for Core Banking Software?

At BMA Banking, we have over 35 years of experience providing innovative and reliable core software solutions. Our customer service is first-class, and we listen and act to achieve your needs. We are precise and deliberate in everything we do and strive to provide tailored services that meet your needs.

Our client services include a personally assigned account executive that is experienced and will provide problem-solving solutions. With BMA Banking as your core provider, you can trust that we put you first every time. Request a discovery meeting with our team to learn more today or call 801-505-0714.