In March 2020, no one could have anticipated how much the COVID-19 pandemic would change how we live, work, and, yes, even bank. Remote work has become the new norm for many people, and with everyone working from home, banks have had to change to accommodate their changing customer base.

So, what’s the COVID impact on banking, and how are financial institutions refocusing on customer service banking? Let’s find out.

Banking Changes

Here are the areas where we’ve seen the COVID impact on banking and how financial institutions have responded to them.

Customer Support

Clients come into the bank for numerous reasons, but that changed due to COVID-19. With clients and bankers heading home for remote work, financial institutions couldn’t offer the customer service banking they used to. Now, banks need to reimagine the customer experience through a digital lens and provide online support to match.

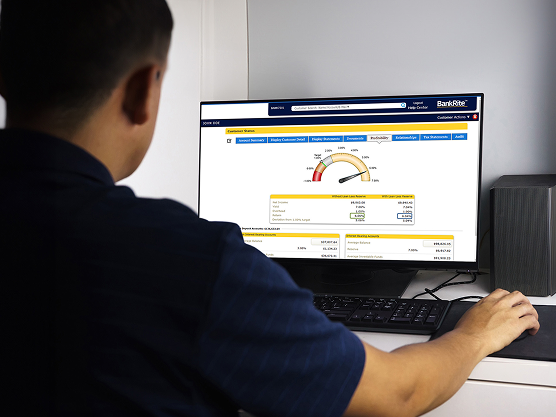

One of the best ways banks have increased customer support is by digitizing all services. Additionally, they have been ensuring employees are trained and have access to all the information they need to provide complete banking customer service.

Serving Vulnerable Groups

During the height of the pandemic, when everyone was staying home, and banks were closed, these financial institutions needed to find a way to bring their services to clients everywhere. One of the groups most affected by the pandemic and bank closures were clients considered vulnerable — including those with weakened immune systems and elderly customers who rely on a physical bank for all their financial needs.

Elderly clients are also easily targeted by cybercrimes, including phishing scams, which are harder to catch and address when these customers aren’t coming into branches. Banks have had to find new ways to focus on their customers while protecting them and their financial interests.

Client Engagement

One COVID impact on banking that has been an ongoing problem during the pandemic is client engagement. When clients aren’t visiting their local branch, making personal connections and building trust is more challenging, both of which are foundational in customer service banking. To combat this, banks have started using different connection tools like SMS messages, mobile apps, push notifications, emails, and other media options to reach their customers.

This multichannel approach also helps customers interact with the bank, ensuring their concerns are heard, and needs are met.

Improved Payment Service

Electronic payment systems have long been a necessity for many, but when the world went home during the pandemic, it became clear how much people rely on these services. As part of customer service banking, financial institutions have had to create more robust and comprehensive systems to accommodate the influx of users. These systems need to be flexible and dependable to meet remote-access needs.

Remote Workforce Management

When stay-at-home orders went into effect at the onset of the pandemic, everyone switched to remote work, including bankers. You may be wondering — bankers working remotely, how does that work? And we don’t blame you! Bank employees have important customer-facing roles that don’t lend well to remote work. This is why financial institutions have had to change and adapt how bank employees work.

Reskilling

To better match banking customer service to the online world, banks have had to rethink training their employees with new skills. New bank employees haven’t been able to train with or meet their team in person, meaning they are missing out on the camaraderie and connection that comes with working near others.

This means that banks have had to find new ways to teach their employees crucial customer service skills and ensure they feel like part of the team, even if they are working remotely.

Training

Banking technology is updating and changing all the time, and banks need to stay on top of the latest updates to bring the best customer service banking to their remote customers. Banks need to be flexible in their approach to training employees and find a training program that accommodates remote working in financial services now and in the future.

Cyber Security

Cyber attacks against banks increased by 238% in 2020, which has continued to rise in recent years. This rise in attacks can be partially attributed to COVID’s impact on banking since more people are accessing banking services remotely. Banks need to tighten their cyber security approach, and many financial institutions have committed to putting more effort into this area.

Currently, the biggest cyber security threats to banks include:

- Ransomware

- Phishing scams

- Remote work

- IT weaknesses

- Denial-of-service attacks

When banks focus on customer service banking, they can work toward preventing these attacks against their systems and customers, including those continuing to do remote work.

Moving Forward

The pandemic has had long-lasting effects on every industry, including banking, and the changes we see now are likely here to stay. Financial institutions must focus on new technologies and digitized services to continue meeting the needs of all their clients.

If you are looking for growth solutions for your bank, credit union, ILC, or other financial institution, BMA is here to help. We offer customized solutions and technology to meet your company’s unique needs. Whether you’re navigating COVID challenges, opening a new bank, upgrading software, or looking for ways to enhance customer service banking, contact BMA to get started.