The banking and finance industry is constantly evolving. With the help of new technology, traditional banking is getting a modern makeover. At the heart of these changes is core banking technology, which supports integration with third-party vendors through powerful API capabilities. By adopting these flexible core banking SaaS solutions, financial institutions can achieve their strategic goals and improve their ability to move forward on their roadmaps.

Below, we’ll explore the world of fintech banking software, focusing on how API-driven integration reshapes financial services and empowers banks to serve customers better while keeping pace with industry demands.

What Is Core Banking Software?

Core banking software is a financial institution’s central nervous system. It manages day-to-day transactions and updates accounts and financial records.

This system can process banking transactions across multiple areas, including ATMs, branches, internet banking, and mobile apps. As the financial industry evolves, so does the need for flexible core bankingSaaS solutions that can keep up with the rapid changes in technology and customer expectations.

This software also provides the flexibility to integrate seamlessly with third-party systems through APIs. This integration helps institutions meet customer expectations and execute their business strategies.

How Does Core Banking Software Work?

Fintech banking software is made up of various components that work together to ensure smooth functioning. One of the most important features is the ability to integrate external services and solutions through APIs. Here is a look at other features and how this integration contributes to the effective operation of financial institutions.

-

Transaction Processing

- Core banking software manages deposits, withdrawals, and loan activities. Thisintegration lets third-party services, such as mobile apps or payment platforms, connect directly to the bank’s system, giving customers seamless experiences across different channels.

-

Account Management

- Banks can easily manage all of their clients financial needs including savings, checking, loans, and investment accounts with the core software applications. With API-driven integration, banks can easily create new accounts through third-party vendors or fintech apps. This provides the bank with the independence to provide these services with a streamlines customer onboarding and improves operational efficiency.

-

Ledger Management

- Fintech banking software automatically updates the general ledger to maintain a comprehensive record of all bank financial activities. Integration with third-party financial tools ensures records are automatically updated and maintained, even when data comes from multiple external sources.

-

Compliance and Reporting

- Modern core banking technology has built-in compliance features to meet regulatory requirements. APIs also allow easy integration with additional tools as needed and provide additional regulatory system capabilities and reporting tools. With this software, financial institutions can easily meet regulatory requirements more consistently and efficiently.

Why Is It Important to Modernize Core Banking in Fintech?

Financial institutions must modernize their core banking systems to keep up with evolving technology and propel them to stay ahead of their customer needs. API integration is the key to scalability and innovation, which are crucial for executing a bank’s roadmap and achieving strategic goals. Here are a few other reasons why upgrading modern fintech banking software is so important.

-

Technical Consolidation After Restructuring

- Financial institutions often face challenges when merging multiple legacy systems. Modern core banking systems allow technical consolidation by integrating these systems into one platform, streamlining operations, and reducing potential issues.

-

Risk and Compliance Management

- Regulatory demands in the financial industry are becoming more complex. Modern core banking technology and APIs let banks quickly integrate new compliance tools or updates, helping them stay compliant while reducing the burden of manual processes. This adaptability is crucial for institutions navigating complex regulations.

-

Fintech Competition

- To stay competitive in the financial industry, traditional banks need core systems that can support quick innovation and integration with new technologies. Modern core banking SaaS solutions with open APIs let financial institutions integrate with cutting-edge fintech platforms, launch new services faster, and provide better customer experiences — key factors in staying ahead of the competition.

Choosing the Right Core Banking for Fintech

When choosing a core banking solution technology for fintech applications, it’s essential to look for specific features that will support your business needs and growth. Here are crucial features to consider.

-

Enhanced Efficiency and Speed

- APIs enable third-party services to connect seamlessly, providing real-time access to transaction data and improving overall system efficiency. Banks need this flexibility to handle large amounts of transactions without sacrificing speed.

-

Scalability

- Choose a core banking SaaS solution with a scalable architecture. Cloud-based core banking solutions with API capabilities allow financial institutions to expand their offerings by easily integrating new services as they scale.

-

Cost Efficiency

- Your fintech banking software should offer a good balance of features and cost-effectiveness. By using APIs to streamline processes and reduce reliance on multiple platforms, banks can lower operational costs while still offering advanced services.

-

Enhanced Security

- With the rising threat of cyber attacks, you need a core banking technology with advanced security features. Advanced APIs guarantee secure data exchange between the core system and third-party services, providing multi-layered security for customer data and transactions.

-

Regulatory Compliance

- Choose a system that includes broad regulatory compliance tools. API integration simplifies compliance by letting banks automate reporting and integrate with regulatory platforms. This helps you navigate complex regulatory requirements, automate compliance processes, and generate necessary reports to meet industry standards.

</ul class=”list-disc”>

-

Innovation and Integration

- Your core processing system should be able to integrate with other fintech solutions easily. APIs allow institutions to innovate rapidly by connecting with third-party services such as payment processors, digital wallets, and customer analytics platforms.

-

Data Analytics and Insights

- The right core banking solution should provide robust analytics capabilities through integration. By using APIs, banks can connect with data platforms to gain helpful insights into customer behavior, market trends, and operational performance.

The Future of Core Processing in Fintech

Several emerging trends and technologies are shaping the future of core processing in the fintech industry. These advancements are improving how financial institutions operate, work with customers, and manage their data. Below are some of the major developments that highlight the growing importance of API integration in core banking systems.

-

Open Banking

- The move toward open banking is driving the need for core banking platforms with secure APIs that allow integration with external fintech services. This enhances collaboration between banks and third-party vendors, creating more customer-focused solutions.

-

Generative AI

- AI is revolutionizing core banking operations. APIs make it easy to integrate with AI-driven platforms, improving customer service and providing predictive analytics for better decision-making.

-

Advanced Cybersecurity

- Core banking platforms need APIs that support secure communication between the bank and third-party services. These APIs should include multi-factor authentication, encryption, and real-time threat detection to protect sensitive financial data.

-

Cloud-Based Solutions

- The shift toward cloud-based core banking SaaS solutions is expected to continue. APIs let banks easily scale their operations in the cloud and integrate new services without major infrastructure changes. These cloud-based options offer financial institutions more flexibility, scalability, and cost-efficiency.

-

Blockchain

- Blockchain technology offers new possibilities for secure and efficient financial transactions. With API-driven integration, core banking systems can connect with blockchain platforms. This promotes innovations in areas like international payments, identity verification, and contracts.

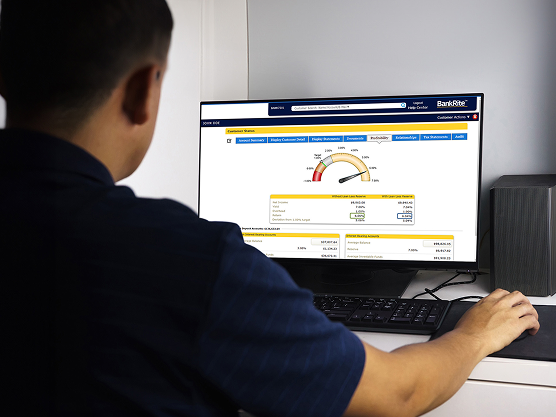

Empowering Fintech Innovation With BMA

Choosing the right core banking solution is paramount to success in the financial industry. BMA offers cutting-edge core banking solution technology that helps financial institutions thrive. Our advanced core banking application offers seamless API access and robust third-party integration to the core system. Our solutions help banks innovate faster, streamline operations, and execute their roadmaps efficiently.

BMA’s core banking application offers flexible API access, helping banks launch new products quickly, adapt to new market demands, and improve customer experiences. With advanced features like smart automation and real-time data analytics, our system empowers institutions to meet strategic goals while focusing on what matters most — providing exceptional service.

Contact us today or email us at marketing@bmabankingsystems.