In today’s fast-paced financial landscape, the importance of core banking solutions cannot be overstated. With technology evolving at a rapid pace, banks are under increasing pressure to meet the diverse and sophisticated needs of their clients. This article will explore the critical role of core processing providers in shaping service expectations, examine the evolving needs of bank clients, and highlight how BMA Banking Systems is positioned to meet and exceed these expectations.

Understanding Core Banking Solutions What are Core Banking Solutions?

Core banking solutions refer to the back-end systems that banks use to manage their operations and deliver financial services to customers.

These systems facilitate various banking functions, such as account management, transaction processing, and data storage. By implementing robust bank core systems, financial institutions can streamline their operations that will propel them to provide better services to their clients.

In the age of digital banking, the banking core is essential for ensuring that banks remain competitive and responsive to customer needs. As such, core banking solutions are not merely tools for transaction management; they are foundational components that enable banks to offer a wide range of services seamlessly.

Advantages of Core Banking Solutions

The advantages of core banking solutions are manifold. Here are some key benefits:

- Enhanced Efficiency: Modern core banking systems automate routine tasks, reducing manual errors and increasing operational efficiency. This leads to faster transaction processing times and improved customer experiences.

- Customer Satisfaction: Banks can significantly enhance customer satisfaction by offering consistent, reliable, accessible, and responsive services. A positive banking experience fosters loyalty and encourages clients to engage more with their financial institution.

- Cost Reduction: Efficient core banking solutions minimize operational costs. This is done by automating processes and improving resource management, banks can allocate resources more effectively and increase profitability.

- Scalability: As banks grow, their systems must be able to scale accordingly. Advanced core banking solutions can adapt to increasing transaction volumes and expanding service offerings, ensuring long-term sustainability.

These advantages of core banking solutions are crucial for banks looking to thrive in a competitive marketplace.

Evolving Client Service Needs in Banking Current Service Expectations of Bank Clients

- Personalized Services: With the rise of fintech and digital solutions, customers are accustomed to tailored experiences. Banks must leverage data analytics to understand individual client needs and offer customized solutions. They must expect and receive quick, efficient, and consistent core services access for resolution of issues and advances needed.

- Technological Integration: Clients now expect seamless integration across various platforms. Whether it’s mobile banking, online services, or in-branch interactions, customers want a consistent experience. Through API access to additional services, the core system must provide expedited access to these additional system advantages to help propel the bank forward with their immediate goals.

- Real/Near-Time Services: In a world where instant gratification is the norm, customers expect real/near-time transactions and updates. Delays in service can lead to dissatisfaction and loss of trust.

Future Service Needs of Bank Clients

Looking ahead, banks must prepare for the following future service needs:

- Greater Integration: Clients will demand more integration between banking services and third-party applications, enhancing the overall banking experience.

- Advanced Technology Adoption: Emerging technologies such as AI, machine learning, and blockchain will reshape the banking landscape. Banks need to adapt quickly to harness these technologies for improved services.

- Focus on Sustainability: As clients become more environmentally conscious, banks will need to develop sustainable financial products and practices that align with these values.

By understanding these evolving needs, banks can better position themselves to meet client expectations and enhance customer loyalty.

The Gap in Service from Larger Core Providers Identifying the Service Gaps

Despite advancements in technology, many larger core providers struggle to meet the nuanced needs of their clients. Common service gaps include:

- Lack of Personalization: Larger providers often deliver generic solutions that do not address the unique requirements of individual banks or their clients. Including system updates and changes in a fast and efficient manner.

- Inefficient Customer Support: Many large providers face challenges in providing responsive customer service, leading to frustration for banks and their clients.

Challenges Clients Face with Existing Core Systems

Clients often encounter significant challenges with existing core systems, such as:

- Inflexibility: Rigid core systems can limit a bank’s ability to adapt to changing market demands and client expectations.

- High Costs: Many banks face escalating costs associated with maintaining outdated core systems, which can hinder investment in innovation.

- Poor Customer Support: A lack of timely and effective support from core providers can lead to operational disruptions and negatively impact client experiences.How BMA Exceeds Client Service Expectations

Innovative Solutions Offered by BMA

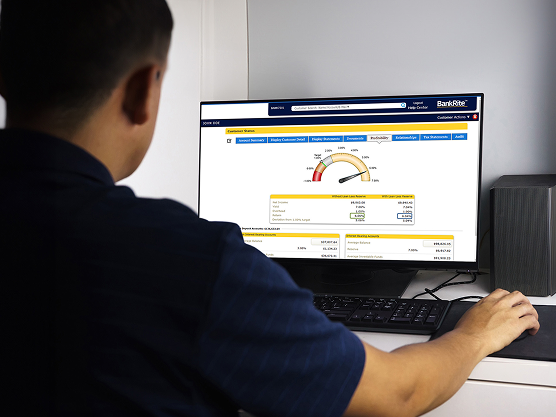

BMA Banking Systems stands out in the crowded financial landscape by offering innovative solutions tailored to meet current and future banking needs. Some of the unique services include:

- Flexibility in the Core Banking Solutions: BMA provides bespoke solutions that address the specific challenges faced by banks, ensuring a perfect and changing fit for their operations.

- Advanced Data Analytics: By leveraging data analytics, BMA helps banks gain insights into client behavior and preferences, allowing for more personalized services.

- Proactive Customer Partnership Support: BMA prioritizes customer satisfaction by offering dedicated support teams that ensure banks have the assistance they need when they need it.

Commitment to Customer Satisfaction

BMA’s commitment to client satisfaction sets it apart from other larger core providers. By focusing on building strong relationships and understanding client needs, BMA ensures that its clients feel valued and supported. This approach not only enhances the banking experience but also fosters loyalty and long-term partnerships.

Conclusion

In conclusion, core processing providers play a pivotal role in shaping the service expectations of banks and their clients. As the financial landscape continues to evolve, it is crucial for banks to adopt modern core banking solutions that enhance efficiency, improve customer satisfaction, and reduce costs.

BMA Banking Systems is uniquely positioned to meet these needs, providing innovative solutions and unparalleled customer support. If you’re looking to exceed your client’s service expectations, consider reaching out to BMA for more information on how they can help transform your banking operations.